Guest Author: Robert E. Jones, CPA, CPCM, NCMA Fellow, Left Brain Professionals

Background

Congress approved multiple COVID-19 relief bills in 2020 to aid businesses and employers struggling with the financial impacts continuing into 2021. The Coronavirus Aid, Relief, and Economic Security Act (CARES) passed in March 2020 included funding for the Paycheck Protection Program (PPP) loans with forgiveness – a mechanism intended to get tax-free money in the hands of small businesses. Additionally, Section 3610 of the CARES Act allows (although does not require) contracting officers, on a contract-by-contract basis, to provide additional funding to contractors to keep staff in a ready state while idle due to facility closures or other restrictions preventing the completion of work. The CARES Act also included the employee retention credit (ERC) – a refundable tax credit – a mechanism to help employers keep employees on the books. The Families First Coronavirus Relief Act (FFCRA), also passed in March 2020, provided employees with 14 days of emergency paid leave.

Concerns for Government Contractors

All of these forms of relief present reporting and accounting issues for government contractors in addition to any tax forms or other documentation necessary to support the respective programs. Government contractors must consider the impact of PPP forgiveness (and other forms of COVID-19 relief) on their contract billings, indirect rates, and incurred cost proposal. In addition to PPP loan forgiveness, contractors have asked about the proper treatment of employer paid leave, the employee retention credit, and other parts of the CARES and FFCRA Acts. We’re here to address those concerns and answer some of your questions.

PPP Loan Forgiveness

Eligible Expenses That Qualify for PPP Forgiveness as a Government Contractor

The list of eligible expenses for government contractors is the same as all other businesses. However, the selection of specific expenses can have a significant impact on indirect rates and reimbursable amounts on cost-type contracts. Whereas most commercial entities simply track and report salaries and wages as a single line item, government contractors must segregate salaries and wages into Direct Labor, Overhead Labor, G&A Labor, and Paid Absences. The segregation of these expenses is critical to the accurate calculation of indirect rates and the respective amounts must be accurately reported on the incurred cost proposal.

Eligible Expenses

- Payroll Costs

- Labor/Salaries

- Group Health Benefits Paid by Employer

- Employer State & Local Taxes

- Retirement Plan Contributions

- Business Mortgage Interest

- Rent

- Utilities

- Covered worker protection and facility modification expenditures, including personal protective equipment, to comply with COVID-19 federal health and safety guidelines

- Expenditures to suppliers that are essential at the time of purchase to the recipient’s current operations

- Covered operating costs such as software and cloud computing services and accounting needs

Since contractors cannot receive payment from the government and PPP loan forgiveness for the same expenses, contractors must carefully select and document the expenses used to claim forgiveness. FAR 31.201-5 clearly states that the contractor must pass on any rebates, refunds, or other credits in the form of reduced costs or cash refunds. By carefully selecting and documenting their forgiveness calculations, government contractors can meet the requirements of FAR 31.201-5 and avoid double-dipping on any government funded payments.

PPP Forgiveness Strategy for Government Contractors

Government contractors should focus on seeking forgiveness of indirect expenses (fringe, overhead, and G&A) without including any direct expenses on government contracts. By claiming forgiveness on indirect expenses, government contractors can still bill the government all direct costs incurred plus the newly adjusted indirect costs.

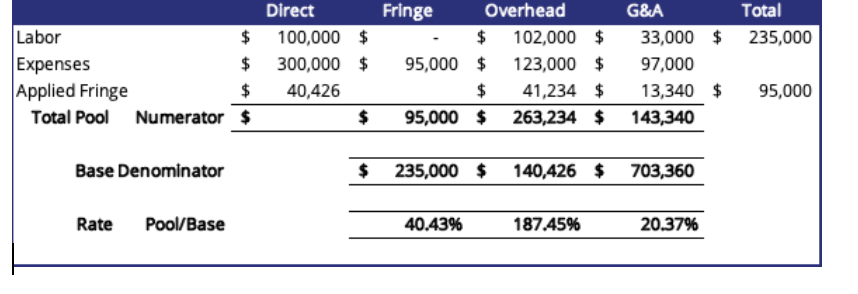

Rates Before Forgiveness Calculation

Example of Forgiveness Application

Rates After Forgiveness

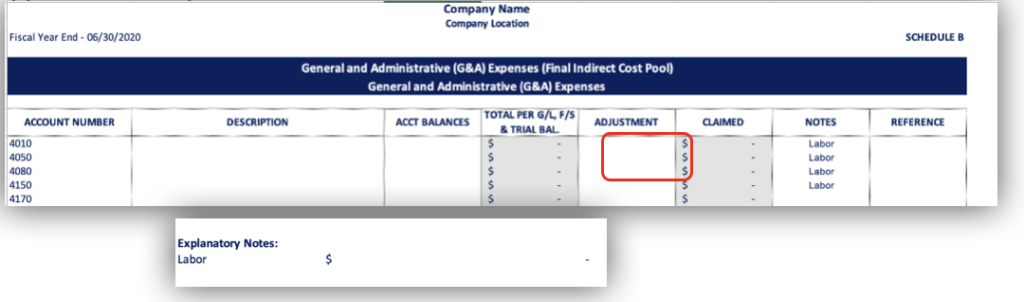

Reporting PPP Forgiveness on the Incurred Cost Proposal

Adjustments to GL balances are reported in the “Adjustment” column on the incurred cost proposal with a note explaining the adjustment. Since PPP forgiveness will cause adjustments to the fringe, overhead, and/or G&A pools, contractors will want to include a worksheet (preferably as a separate tab) showing the calculation of PPP forgiveness funds applied to each pool.

Section 3610 Funding

Section 3610 of the CARES Act permits agencies to modify the terms and conditions of the contract to reimburse contractors who provide paid leave to their employees to keep the employees in a “ready state” while they are unable to work on a site that has been approved by the Federal Government due to facility closures or other restrictions, and are unable to telework. These funds are to be added to the existing contract as a separate contract line item (CLIN) and could be issued as cost-type or fixed price modifications.

These idle costs are now direct costs for those specific contracts since the readiness is a paid deliverable of that contract.

One thing contractors must be careful to avoid is mischarging labor hours for idle employees compensated with Section 3610 funding as indirect costs. Although contractors may assume that compensation of all idle employees should be treated as indirect costs, this is a situation where terms of the contract supersede the normal treatment of a cost in accordance with the contractor’s standard practices and should be noted in the contract, the project/job, timekeeping, and incurred cost proposal.

Reporting Section 3610 on the ICP

Section 3610 funds are billable CLINs just like any other CLIN and will be presented on Schedule H as a separate line item (in the appropriate section) for the affected contracts.

Download a copy of Left Brain Professionals’ incurred cost proposal template.

The Effect of COVID-19 Relief on Indirect Rates

PPP Forgiveness

PPP loan forgiveness, when applied to indirect costs, will reduce indirect rates. For some contractors, this may be their saving grace. At a time when many contractors shifted direct employees to overhead, an opportunity to reduce overhead expenses may be a breath of fresh air.

Section 3610

Section 3610 should work to reduce indirect rates by increasing the amount of direct costs. Remember that direct costs are in the bases of fringe, overhead, and G&A, and that increases in direct costs work to reduce indirect rates by providing a larger base/denominator over which to apply the pool/numerator.

Other FFCRA & CARES Act Relief

The principles addressed here apply to other forms of relief including employer paid leave, employee retention credits, and deferred payroll taxes. Any cost reimbursed, refunded, or credited through any relief program (regardless of its tax treatment) must be credited back to the government in the form of a cost reduction.

Best Practices

Document, document, document.

As with all things legal and accounting, documentation is key. Contract and incurred cost audits often occur months or years after the fact making the explanation of events more difficult as time passes. Factors necessitating accurate recordkeeping that make accounting documentation in 2020 even more important:

- Multiple forms of relief

- Varying and extended eligibility dates

- Various reporting requirements

- Differing tax treatments.

The issues discussed in this article will result in different amounts reported for book, tax, and incurred cost purposes. Contractors will want to develop and maintain a worksheet identifying the expenses claimed for each, and a reconciliation between and among the differing reported amounts. We recommend filing a copy of the worksheet and reconciliation with the PPP forgiveness application, financial statements, income and payroll tax returns, Section 3610-affected contracts, and the incurred cost proposal.

Please contact Left Brain Professionals for help with the accounting impact of PPP loan forgiveness, indirect rates, and the incurred cost proposal.

A version of this article is also posted at Left Brain Professionals.

About the Author

Award-winning speaker Robert E. Jones shows audiences how to navigate the constantly changing legal and regulatory landscape of government contracts. In his engaging and highly rated presentations, he shares insider secrets drawn from more than 17 years of DoD contract and accounting experience. His proactive, decisive approach to finding opportunities and solving problems is based on experience in managing more than $400 million in federal contracts.

Mr. Jones has experience with a wide variety of speaking engagements including emcee/moderator, seminars, training, chapter meetings, and conference presentations. He engages audiences with innovative approaches to contract profitability, accounting, compliance, and related topics.

The West Virginia native earned a bachelor’s degree in accounting from the McColl School of Business at Queens University of Charlotte in North Carolina. He holds a master’s degree in accountancy from The Graduate School of the College of Charleston in South Carolina. He is a licensed CPA in the State of Ohio, a Certified Professional Contracts Manager (CPCM), and a National Contract Management Association (NCMA) Fellow.